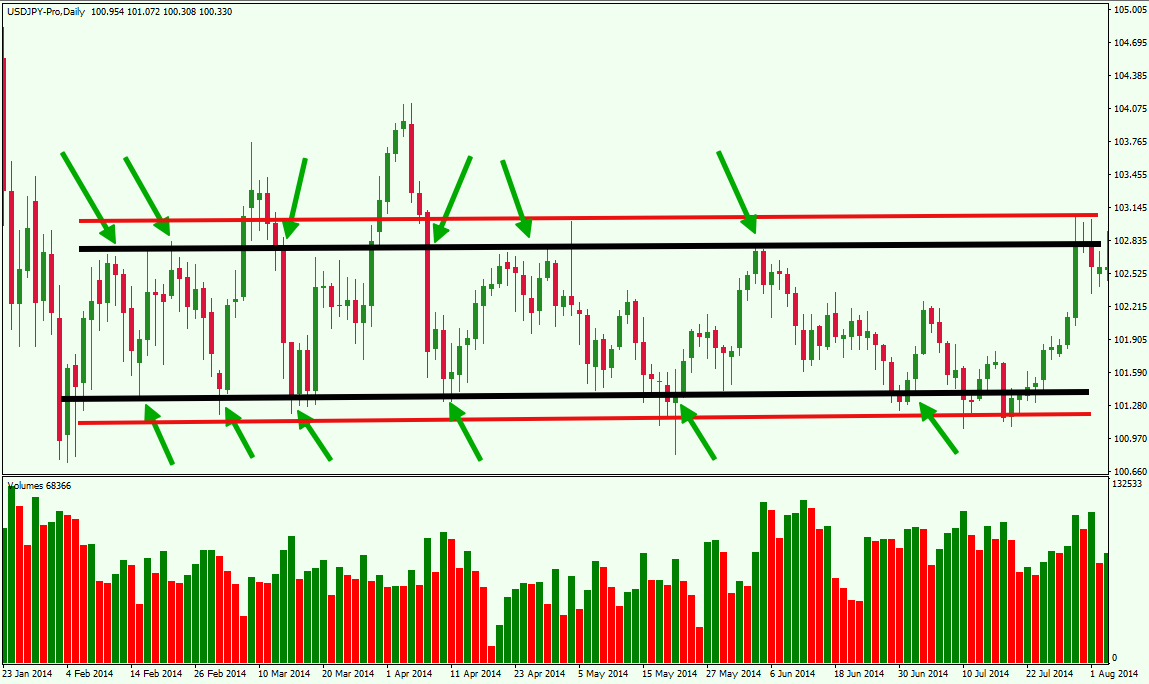

Rational to expect range-bound activity?

Something clearly happened last week that took the wind out of the market’s sails. But what exactly? And why did it take an interest rate cut to trigger such a harsh correction?

Let’s consider a few points.

The MPC (Monetary Policy Committee) announcement came after market hours on Monday, 16 December 2024, so the effect was seen – blood on the trading floor in this case – all through Tuesday, 17 December 2024.

Initially some thought it was a somewhat exaggerated version of the buy-the-rumour-sell-the-news phenomenon that’s been seen on almost all MPC announcements since the SBP turned dovish some months ago. But a 10,000-odd point drop over three days, erasing all the gains of the previous week, and then some, in what is a very volatile market, clearly stretches the limits of the sell-the-news argument.

So something else was, and still is, happening.

It’s important to note that not much has changed from the point of view of the market.

Inflation is still at a multi-year low, the Saudi loan rollover is still expected to be followed by a similar gesture by the Emiratis, and the opposition has called off, at least for now, its civil disobedience movement and commenced talks with the government, so political tension is also not a worry for the time being.

Plus a rate cut, even if below the extreme 500 basis points demanded by some businesses, is still market positive. And even if, for the sake of argument, it is too little to be market positive (which it is not), it is still in no way market negative.

So it’s safe to assume that the poison that removed about 5,000 points from the index in a week and snapped the furious bull run must have come from outside the market, perhaps even outside the country.

Some more points are important.

One, perhaps there is some truth to rumours that tweets from Trump’s appointment as envoy for special missions, so strongly in favour of Imran Khan, imply an impending breakdown in Pak-US relations. Where there’s smoke there’s fire, and indeed Richard Grenell’s tweets and statements, one even calling for Haqiqi Azadi in Urdu, could signal game-changing diplomatic turbulence ahead.

Two, even as the US, UK and EU have criticised the use of military courts to try civilians, the Union has also highlighted potential implications for Pakistan's status under the Generalised Scheme of Preferences Plus (GSP+).

The EU stated that these verdicts appeared inconsistent with Pakistan's obligations under the International Covenant on Civil and Political Rights (ICCPR), which mandates fair and public trials before independent and impartial courts.

The EU emphasised that as a GSP+ beneficiary, Pakistan has committed to effectively implementing 27 international core conventions, including the ICCPR.

Needless to say, of course, that a possible revocation of GSP+ would be a severe economic blow to Pakistan, worsening unemployment, reducing export earnings, and straining foreign reserves – a clear market negative.

And three, an editorial in Business Recorder, Fresh Borrowing (26-12-2024), suggests that the government might have “over-estimated its capacity to borrow externally in the budget, which was severely compromised due to failure to borrow the budgeted amount from the commercial banking sector abroad and through issuance of debt equity (sukuk/Eurobonds) as the three major international rating agencies — Moody’s, Standard and Poor’s and Fitch — rated Pakistan in the high risk of default category in spite of the then ongoing nine-month $3b Stand-By Arrangement by the IMF”.

This implies that there might be far less in the kitty than originally estimated to enable the government to pay off the interest on past loans, the principal as and when due, and for budget support. This is also strongly market negative.

If these issues really combined to deliver the hard bear hug to the market last week, then it might be a while before there’s enough clarity to resume the uptrend.

And, (speaking for technical analysts, at least) while traders work out Elliot Wave and Fibonacci patterns to see if a short or long term top has been formed), last week’s drop does beg the obvious question of whether, in the immediate term, it is rational to expect range-bound activity?

Disclaimer: This content is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a licensed financial professional before making any investment decisions.

.png)