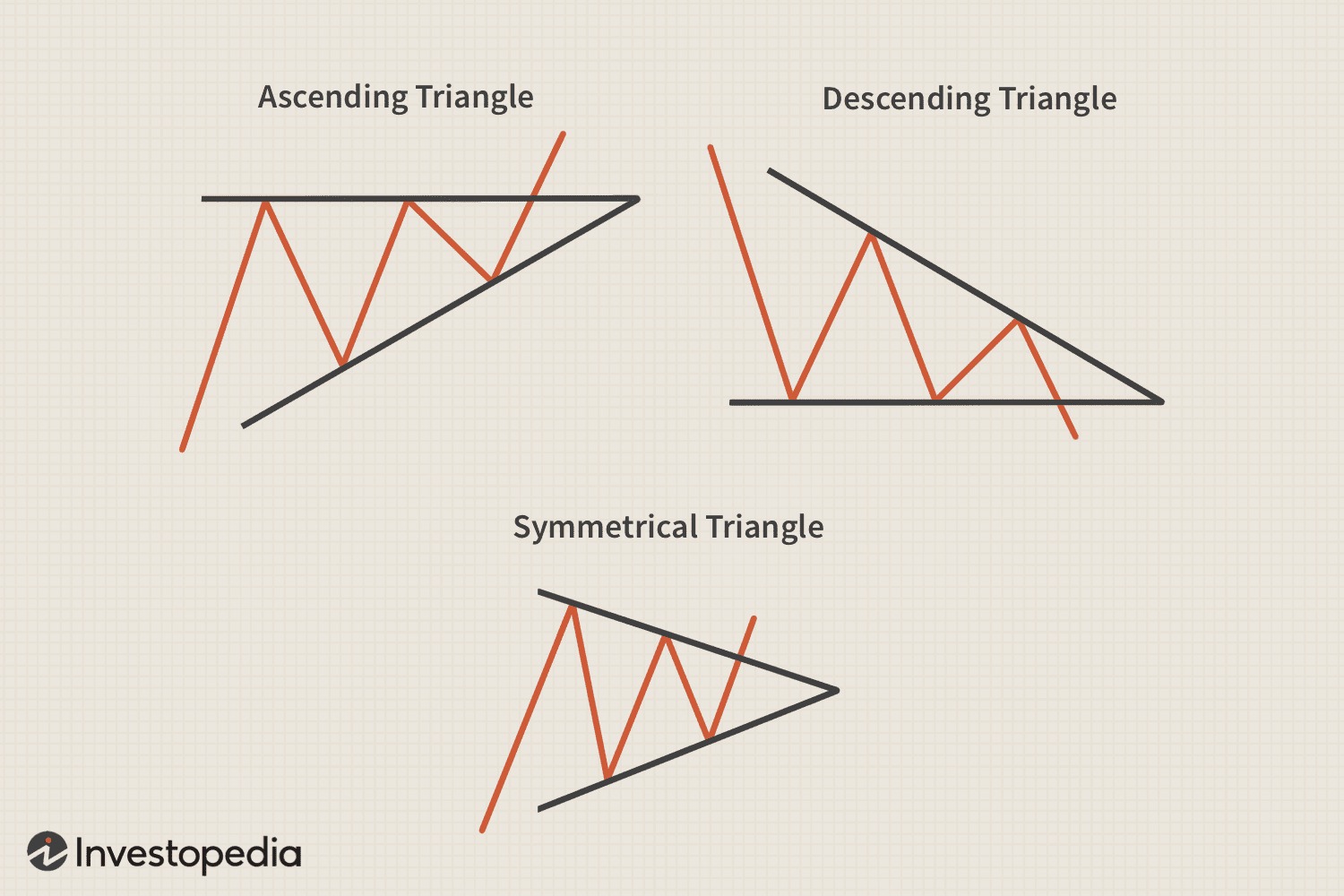

In technical analysis, the triangle formation is probably the most widely recognisable consolidation pattern.

Indeed, as the KSE100 Index made a top at 117039.17 on 17 December 2024 and dominant market sentiment tilted towards consolidation, the market entered a triangle formation.

Following points and questions are important:

• Strong uptrend compressing into a triangle on declining volume.

• Shows lack of conviction among buyers in the direction of the trend BUT selling pressure is also weak (indicated by shrinking volume).

• Price patterns is coiling towards an apex, and given high volatility – 14-period ATR (Average True Range) reading of 2857.90 implying a near-3000 point move when market opens – the textbook expects the index to snap in whichever direction it breaks out.

• Important: Market fundamentals have not changed since the interest rate cut triggered market correction, raising the question if recent sharp decline was institutional off-loading – big/smart money repositioning.

Disclaimer: This content is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a licensed financial professional before making any investment decisions.